Subscription brands are a little different from typical ecommerce brands. These business types are usually based on some recurring monthly or yearly subscription of a direct-to-consumer product. Popular subscription brands include The Dollar Shave Club, Ipsy, FabFitFun, and Fabletics. While these are still considered ecommerce businesses they require different email journeys for their subscribers such as onboarding, cancellation, and winback journeys. We took a look at 5 different subscription groups (apparel, beauty, food & drink, kids, and health & wellness) to give you a better snapshot of subscription brands and their behaviors.

Apparel subscription brands had a -16% decrease in cadence YoY.

Sending Cadence YoY: 2019 vs. 2020

Looking at the MoM sending cadence trendline, the number of emails sent slowed two months leading up to the pandemic. Using MailCharts data, we’re also able to get more granular with brand-specific data. With the sending behavior report, we’re also able to see the brands with the highest volume: Fabletics, JustFab, and Dia&Co with Fabletics sending more than 3x than the average for the category.

Looking at the MoM sending cadence trendline, the number of emails sent slowed two months leading up to the pandemic. Using MailCharts data, we’re also able to get more granular with brand-specific data. With the sending behavior report, we’re also able to see the brands with the highest volume: Fabletics, JustFab, and Dia&Co with Fabletics sending more than 3x than the average for the category.

Beauty subscription brands saw a -32% decline in emails containing a promotion YoY.

Emails Containing a Promotion 2019 vs. 2020

For the majority of the first half of 2020, beauty brands had fewer emails containing a promotion which has since recovered to ‘normal’ 2019 levels in Q4 2020. While overall emails containing promotions decreased, there was a slight increase of +10% in monthly sending volume leading us to believe that the beauty subscription industry was negatively impacted by the pandemic and brands were trying to use email to drive higher AOV and revenue.

Food & Drink subscriptions saw a surge of +30% in sends after March 2020

Sending Cadence YoY: 2019 vs. 2020

With more people eating at home and avoiding public places, food and drink subscription brands had an opportunity to shine. Looking at the MailCharts sending behavior and promotions report, we see a large increase in sending volume YoY and decreased emails containing a promotion during the same timeframe (with more promotions towards the holiday season).

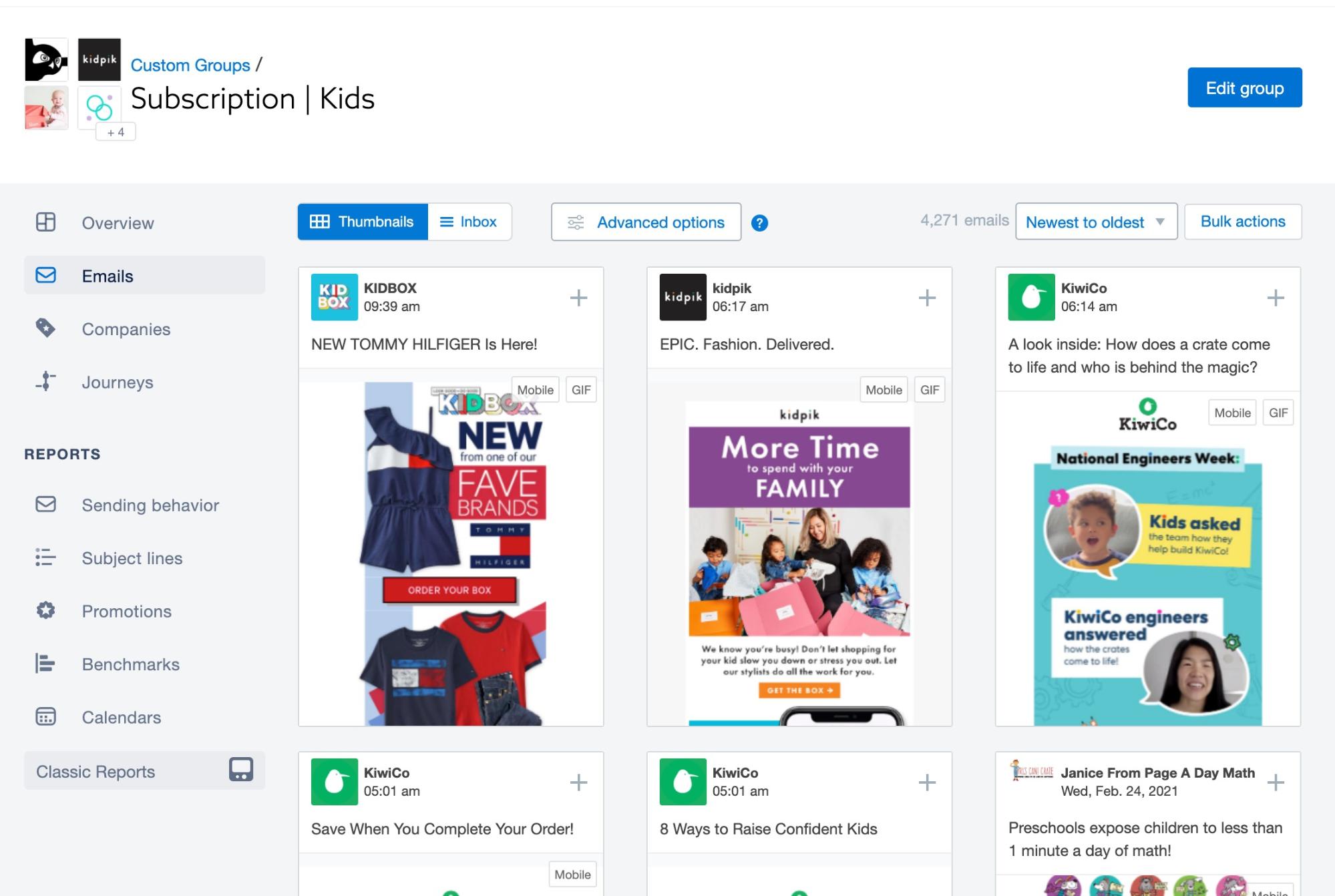

More than 4k kid subscription emails are cataloged within MailCharts.

Emails from Kid Subscription Brands

Using MailCharts, search and filter emails by kid subscription brands using our advanced search filters in the group ‘Email’ section. We also have 30+ journeys to inspire your next initiative for kid subscription brands, too!

Health & Wellness subscriptions also saw a +20% increase in sends by brand YoY.

Sending Cadence YoY: 2019 vs. 2020

Similar to what we saw for apparel subscription brands, health & wellness subscription brands also saw an increase in email volume and a decrease in emails containing a promotion. According to the MailCharts Promotions report, Ritual, Aaptiv, and Quip had discounts in over half of their emails sent.

MailCharts Tip of the Week:

Compare a brand within a category to the category averages

When looking at high-level reporting insights, you may see a few brands catch your eye (for example, Fabletics above with their aggressive sending cadence). Navigate to a group’s Benchmark report and compare a brand against the group to see if there are additional insights. How did this brand perform against others in the group in terms of emails containing a promotion? Sending cadence? Subject line length? Sign up or log in to explore our benchmark reports.